BOSTON, July 25, 2023 (Newswire.com) - With the fall semester fast approaching, a new class of students is considering how to finance the college bill. The choices made today will impact families for years to come.

That's why MEFA is urging students and parents to minimize borrowing and understand the long-term obligation of student loans. As an authority on planning, saving, and paying for college, MEFA offers a wealth of free guidance at mefa.org.

"The national debate on forgiving federal student loans has started a thoughtful conversation among new borrowers about how to achieve the college dream while minimizing indebtedness. A college degree remains a solid investment for many career choices, and MEFA is here as a public resource to help families. Together, we can reduce borrowing, carefully consider financing options, and place students on a course toward career and financial success," said Thomas Graf, Executive Director of MEFA.

To minimize borrowing, MEFA advises families to:

- Use savings to pay for as many college costs as possible. This avoids interest payments that would accrue on a loan.

- Ask the college about a monthly payment plan that allows all or a portion of the bill to be paid with interest-free, monthly installments.

- Plan to work part-time to pay for daily expenses.

If families need to borrow, MEFA advises students and parents to complete the FAFSA to receive Federal Direct Student Loans. These types of loans typically offer favorable terms and conditions.

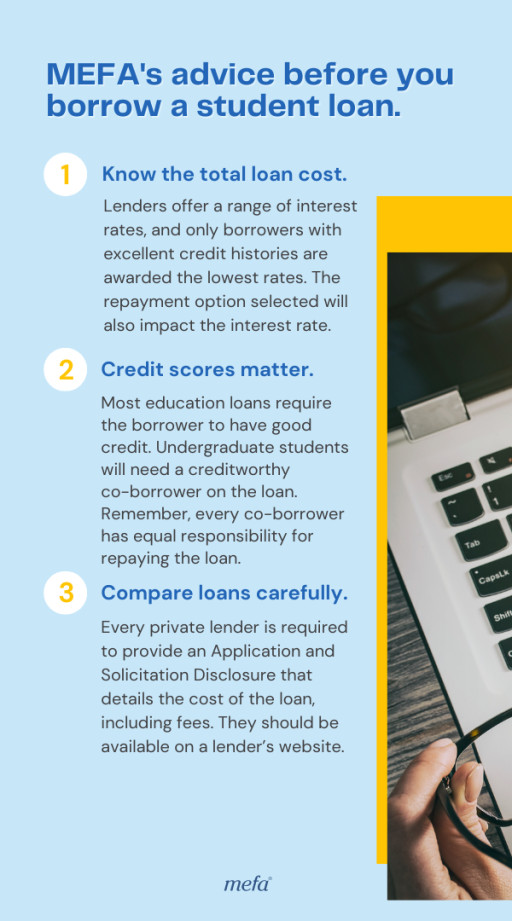

If additional funds are needed, students and parents can turn to private loans. With those, MEFA advises:

- Know the total cost of the loan. Lenders offer a range of interest rates, and only borrowers with excellent credit histories are awarded the lowest rates. The repayment option selected will also impact the interest rate. The loan's interest rate can significantly affect the loan's total cost.

- Understand that with private loans, credit scores matter. Unlike the Federal Direct Student Loans, most education loans require a creditworthy co-borrower on the loan to increase the chances of approval and a lower rate. But remember, every co-borrower has equal responsibility for repaying the loan.

- Compare loans carefully. Every private lender is required to provide an Application and Solicitation Disclosure that details the cost of the loan, including fees. MEFA's 2023-24 Disclosure shows fixed interest rates between 5.35% and 7.95% APR*, with no application or origination fee, and no late or returned check charges. It includes the cost of various repayment options.

MEFA's experts are available to help with guidance on paying the college bill at (800) 449-6332 or by emailing [email protected].

Visit mefa.org for free college planning guidance including webinars, videos, the MEFA Podcast, and articles covering a full range of college planning topics.

*The Annual Percentage Rate (APR) is designed to help consumers understand the relative cost of a loan and reflects the loan's interest rate, timing of payments, and fees. MEFA's lowest rates are only available to the most creditworthy applicants.

Contact Information:Lisa Rooney

Public Relations Manager

[email protected]

(617) 224-4838

Original Source: MEFA Offers Strategies to Minimize Student Loan Borrowing